Warrant Handbook Strategies

Warrant Handbook

1

Advantages of Trading Warrants

Gearing Effect

Structured warrant is a leveraged financial instrument which allows trader to gain exposure to the underlying asset at a fraction of the cost to purchase underlying asset.

Lower Transaction Costs

With lower transaction amount of the structured warrants, the brokerage fees for the structured warrant trades will be relatively lower as compared to underlying share trades.

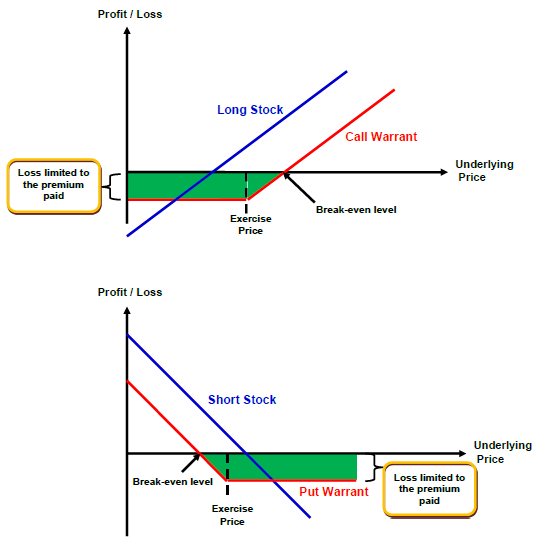

Maximum Potential Loss

Profit from Bull & Bear Market

Without having to worry about any margin call, investor can choose to purchase put warrants should he/ she has a bearish view on the market. And of course, one can also purchase call warrants should he/ she has a bullish view on the market.

Portfolio Hedging

For investor who has a portfolio of shares which has high dividend yield, and he/she has a bearish view on the market, yet do not wish to sell off the shares, one can choose to buy put warrants to hedge their portfolio.

In the case where the bear market hits, their losses in the equity market can be partially or fully compensated by the gains in the warrants market.

Gain Exposures to Different Sectors

There are various sectors in the market; some of the investors might not have sufficient capital to invest in every sector he/ she wishes to. Therefore, they can purchase warrants which require little capital and gives them the similar exposure to different sectors at the same time.

2

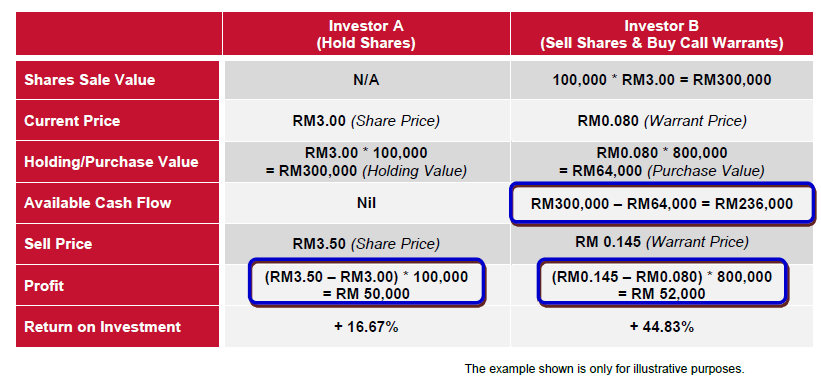

Cash Extraction

One can sell off their existing shares to monetize gains and use a small portion of funds to purchase call warrants in order to maintain a similar exposure of the shares without having to forego any potential upside in the shares. Later, invest the remaining funds in business, property or assets with higher return.

For example,

Both Investor A and Investor B are holding 100,000 shares of ABCD shares which worth RM3.00, and think that ABCD share has potential upside:-

- Investor A chooses to hold the existing 100,000 ABCD shares

- Investor B chooses to sell the existing 100,000 ABCD shares to free up some cash flow; then buy the call warrants, ABCD-CA to maintain his stock exposure in ABCD share

Assuming ABCD-CA has warrant price of RM0.080 with effective gearing of 4.7x.

Thus, investor B should purchase RM64,000 (RM300,000 ÷ 4.7 ≈ RM64,000) value worth of warrants, which is equivalent to 800,000 (RM64,000 ÷ 0.080 = 800,000) warrants.

Both investors have gain profit about RM50,000 from the shares, but Investor B is able to extract cash of RM236,000 from the previous portfolio and invest them in other businesses or assets which offer higher return.